ANALYSIS OF THE SOCIAL SECURITY CODE 2020 IN LIGHT OF THE GIG AND PLATFORM ECONOMY

ANALYSIS OF THE SOCIAL SECURITY CODE 2020 IN

LIGHT OF THE GIG AND PLATFORM ECONOMY

WRITTEN

BY: KITTU SHARMA

3rd YEAR, LL.B [2019 - 2021]

GOVERNMENT P.G. LAW COLLEGE, BIKANER

CAREER COLLEGE OF LAW, BHOPAL

ABSTRACT

Social Security has been considered to be one of the best strategies to lessen the financial anxieties of the working people in several different nations. Since the commencement of the programs in India, there has been considerable discussion about the industries and groups to which such social security systems apply. The Social Security Code was enacted in 2020 to update and harmonize the rules governing social extend India and extending social security to all employees, regardless of whether they work in the organized, unorganized, or any other sector. This article delves into a deep examination of the Code, attempting to lay out its key aspects, new incorporations, gaps, and how far the Code can actually fulfill the objective of mitigating the consequences of the economic crisis on the country's poor and needy. The article also proposes to analyze the Code's many rules about the unorganized, gig, and platform-based workers and to highlight its various inadequacies.

INTRODUCTION

The revised Labour Codes, which the

Parliament adopted in September 2020[1], recognize gig and the platform

workers as new occupational categories in India. The Code replaced nine pieces

of legislation that offered social security to employees, including the “Maternity

Benefit Act, Employees' Provident Fund Act, Employees' Pension Scheme, and

Employees' Compensation Act.” This Code attempts to ensure consistency in

providing social security benefits to employees, which were formerly separated

under multiple legislation with varying applicability and coverage. In

addition, by recognizing and protecting workers in the unorganized sector, the

Code intends to provide social security to a larger number of employees.

Several new notions, such as gig workers, platform workers, fixed-term

employees, and so on, have emerged that were previously unrecognized by labor

legislation. The government has also released draught guidelines enshrined in

the Code. We'd like to discuss the new concepts and the benefits they get under

the Code in this Article.

WHAT IS THE CODE OF SOCIAL SECURITY IN INDIA?

BACKGROUND

The Code on Social Security 2020,

which was approved by Parliament in September and has already obtained

presidential assent, provides social security to gig and platform workers as well as those operating in the

unorganized sector. In this case, the insertion of gig and platform workers

under the ambit of labor regulations was defined for the first time. Although

the government has taken an excellent move, there are still worries about how

to make the registration as broad as possible, as well as reservations about

overlapping categories. According to “Section

2(86) of the new bill, a gig worker is someone who participates in a work

arrangement and receives payment for it outside of a traditional

employer-employee relationship,” The Code on Social Security is one of four

labor codes passed by Parliament in 2020. Under the Labour Codes, which are

contained in the Constitution's Concurrent List, a rule must be created by both

the Central Government and the State Governments. The Code on Social Security

(Central) Rules, 2020, and the Code on Social Security (Employee's

Compensation) (Central) Rules, 2021 have been pre-published by the Central

Government for public comment as a first step toward the execution of the said

Code. The Rules under the aforementioned Code have already been pre-published

in 21 states/UTs. For the very first time, legislation governing gig and

platform workers has been introduced into the 2020 Social Security Code.

Employees' Provident Fund Organisation (EPFO) and Employees' State Insurance

Corporation (ESIC), previously provided social security benefits to workers in

the organized sector, can now implement the Code's social security benefits by

creating several schemes for gig & platform workers.

A Social Security Fund has also been formed under the Code, with aggregators contributing between 1 and 2% of aggregators' annual sales, subject to a 5% maximum on the amount which is paid or payable by aggregators to such workers[2].

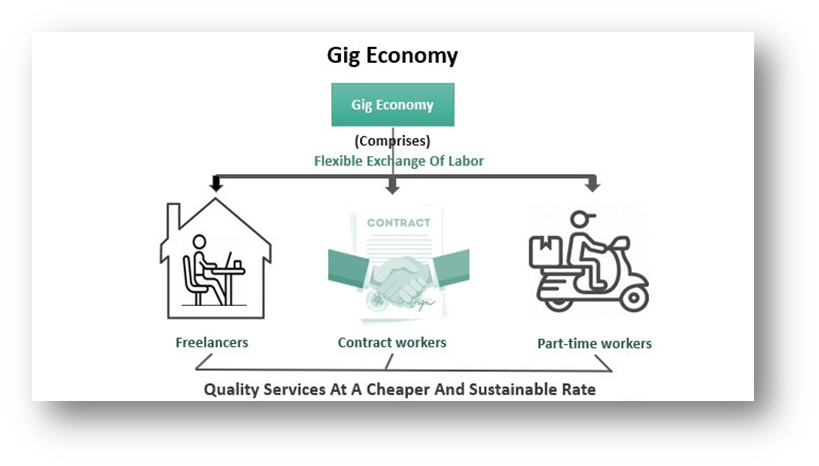

WHAT IS A GIG ECONOMY?

The gig economy is centered on temporary

or freelance work, most of which involves online client or customer

communication. Workers, firms, and consumers may all benefit from the gig

economy by making labor more responsive to the desire for flexible lifestyles.

GIG WORKERS

The term "gig worker" is a

relatively new concept in India. Generally speaking, these workers are

those who work hourly or part-time in fields ranging from software development

to catering.

· The role is typically temporary and

must be done within a particular time frame.

· They have an unusual work

arrangement with their employers and a unique employer-employee relationship.

· According to Section 2(35) of the

Code on Social Security, 2020, a gig worker is "a person who performs work

or participates in a work arrangement and earns money from all such activities

which are outside of traditional employer-employee relationships."

· Gig workers include independent contractors, contingent workers, and freelancers. A gig worker may also include a part-time lecturer.

The gig economy is a popular concept among young people in the West. The approach enables students to begin working at a very young age and get experience in their chosen industries. The benefits associated with such employment would inspire people in India to pursue such careers and get the rewards that come with it. Self-employed people are already classified as unorganized workers. This would have prevented the requirement for separate and different programs for the three main worker groups. Section 109 of the statute provides for social security coverage for employees in the unorganized sector. Section 114 makes social security available to platform and gig workers.

PLATFORM WORKERS

A platform worker is a person employed by a business that provides particular services to customers or clients via a digital platform. Drivers for Ola or Uber, delivery workers for Swiggy or Zomato, and other platform employees are examples.

A platform worker is defined by the

Social Security Code as "a person engaged or involved in platform

work." "Platform work" is also defined in Section 2(55) of the

Code as a sort of employment in which businesses or individuals connect with

other businesses or persons online in exchange for money in order to solve

specific problems or provide specific services.

MANDATORY REGISTRATION AND ISSUES WITH THE REGISTRATION

PROCESS

According to

the Central Government, in order to be eligible for benefits under the Code,

both gig and platform employees must register on a website. However, this

registration is subject to the following conditions being satisfied:

· The worker has turned sixteen but is

under sixty years old;

· The worker has worked at least 90

days during the previous twelve years;

· He has filed a self-declaration electronically

or through another mechanism, in the format and with the details the Central

Government may stipulate.

The Code provides social security

benefits to gig and platform employees, as well as other unorganized workers.

The code gives the Central Government the authority to create assistance

programs for unorganized sector workers for

● Accident coverage

● Disability and life insurance

● senior protection

● benefits of pregnancy and good

health

● Creche

● Any additional benefit the central

government deems beneficial

Every

gig worker , unorganized worker, & platform worker are required to register

under section 113 of the Code and submit supporting documentation, including

their Aadhaar number. As the Supreme Court of India has refused to make Aadhaar

mandatory in numerous cases, making it mandatory for registration is not

legally tenable. Denying social security to a deserving worker because he or

she lacks an Aadhaar card may be considered harsh, if not illegal, under these

circumstances. Overall, the Government of India led by Narendra Modi has made a

commendable attempt by including gig and platform employees in the scope of

social security under this code. Another sort

of employment in the unorganized economy is

gig and platform work.

When it comes to providing social security for

workers in the unorganized sector, there should not be any contradiction

between the two competent governments. Furthermore,

Aadhaar should not be required for worker

registration in the unorganized sector. Simultaneously,

things may appear clearer, with fewer overlapping meanings and

ambiguities.

(According to the NITI Aayog Report,” India's gig labor now

totals 77 lakhs (2020-21). By 2029-30, it is predicted to reach 2.35 crore. Gig

workers will account for 4.1% of India's total workforce by 2029-30, up from

1.5% in 2020-21. Currently, 27 lakh gig employees (35% of all gig workers) work

in retail trade and sales, while 13 lakh (17%) work in transportation.

Manufacturing employs 6 lacks (8%), people, while banking and insurance employ

another 6 lacks (8%) people.”)

SIGNIFICANCE OF GIG AND PLATFORM WORKERS

Introducing these concepts to

students would enhance their job prospects and encourage them to pursue

non-traditional careers. In addition, the business would be less burdened by

not engaging in traditional long-term employment agreements with its employees.Such

laborers can amass wealth, which they can subsequently invest in agriculture

work.

● The pandemic has highlighted the

vital role gig and platform workers, such as delivery drivers and agents, play

in the economy. They made certain that people's fundamental needs were met at

their residences.

● These employees also assisted

several platform companies in staying afloat throughout the pandemic and

subsequent economic crisis.

● This sector has significant growth

potential due to the rapid rate of urbanization.

● The remittances sent through

platforms and gig workers are also helping to grow rural communities.

● Students will be encouraged to look

for non-traditional employment through such work.

● It would also reduce the load on

businesses by assisting them in avoiding the traditional employment structure.

SOCIAL SECURITY 2020: ISSUES FOR GIG WORKERS

● Some experts are worried about how

the amended rule would affect gig and platform workers.

● Platform workers lack labour rights

but are entitled to the benefits provided by the Social Security Code.

● They have no right to sue for a more

steady and higher pay package, or to challenge the algorithms used by the

platforms that assign employment to them. The requirements for claiming

benefits may disqualify some employees.

● In accordance with the Code, the

central government, platform aggregators, and employees all have a

responsibility to provide basic welfare measures.

● However, it does not identify which

stakeholder is responsible for providing what amount of benefit.

● Some argue that the definitions of

unorganised, gig, and platform workers are all overlapping. As a result, it is

unclear how initiatives specific to these employees will be implemented.

CONCLUSION

The gig/platform economy is a

relatively new concept in the global environment. However, nations like the

United States and the United Kingdom have made tremendous headway in

simplifying and altering their rules through judicial precedents to make them

more accommodating for these types of employees. Instead of creating six simple

instructions hidden as statutory provisions, India might steal a page from

their book and adapt our law to such workers.

The Code already incorporates

obligations to safeguard and provide welfare to organised sector employees

based on evolving legislation and precedents. Rather than creating a separate

chapter for the unorganized/gig/platform sector, they might strive to

incorporate gig/platform employees into the same standards, or they could add

equivalent provisions to Chapter IX of the Code. The Indian government sets

aside a major portion of the country's GDP (7.3% in 2018-19) to fund various

social welfare initiatives; a small piece of this vast sum can also be used to

establish a separate fund for gig/platform workers. To ensure openness and

frequent audits, such a fund should be established under the jurisdiction of

the Right to Information Act of 2005.

REFERENCES

- Daily Rated Casual Labour V/s. Union of

India, (1988) 1 SCC 122

- Kingshuk Sarkar, “Under new labor code,

and Uber driver can be both gig and platform worker. It’s a problem”, (The

Print, 12th October 2020),

https://theprint.in/opinion/under-new-labour-code-an-uber-driver-can-be-both-gig-and-platform-worker-its-a-problem/521628/

Accessed 10th May 2021

- Justice KS Puttaswamy V/s. Union of

India, (2019) 1 SCC 1

- (Press Information Bureau, 4th

July 2019), https://pib.gov.in/Pressreleaseshare.aspx?PRID=1577032>,

Accessed on 2nd June 2021

- Shikhar Verma, “Critical Analysis of the Social Security Code in Light of the Gig and Platform Economy”, (India Law Journal) https://www.indialawjournal.org/critical-analysis-of-the-social-security-code.php

Comments

Post a Comment